Senators Elizabeth Warren and Michael Bennet have also proposed estate tax reforms but do not provide enough detail to perform a full analysis. In this photo the progressive lawmaker speaks to reporters in the Senate Subway during a roll call vote on April 13 in Washington DC.

Like us on Facebook.

Bernie sanders taxes 13. Thu May 13 2021. Democratic presidential candidate Bernie Sanders and his wife paid 27653 in federal income taxes in 2014 an effective federal tax. Senator Bernie Sanders introduced the For the 998 Act in 2019 a bill which would expand the federal estate tax and which he still champions in his presidential campaign.

May 10 2021 719 pm. Bernie Sanders Is Mostly Right About the SALT Deduction The state and local tax deduction overwhelmingly benefits rich households in high-tax states while shifting their federal tax. Tom Malinowski D-7th Dist a member of a caucus of nearly three dozen House members of.

Bernie Sanders would narrowly dodge Biden tax hike Sanders made 350760 last year -- just below the 400000 limit proposed in Bidens tax hike. Bernie Sanders opposes push to reinstate SALT deduction. Senator Bernie Sanders I-Vermont accused Republicans of attempting to raise taxes on working families in a Saturday tweet.

Bernie Sanders is taking on the leaders of his own Democratic Party for supporting a repeal of the cap on deductions for state and local tax on federal income taxes. In this photo progressive legislators talk to reporters in the Senate subway during a roll call vote on April 13 in Washington DC Stephanie Reynolds Getty Images. Presidential candidate Sen.

Bernie Sanders slams restoring tax deduction that benefited California as giveaway to wealthy and powerful Tal Kopan May 10 2021 Updated. Senator Bernie Sanders told Axios on HBO he opposes the efforts by Democratic leaders Chuck Schumer and Nancy Pelosi to bring back SALT the State and Local Tax deduction that benefits wealthier residents of. Senator Bernie Sanders I-VT had harsh words for House Speaker Nancy Pelosi D-CA and Senate Majority Leader Chuck Schumer D-NY for their effort to reinstate the State and Local Tax.

Sanders had about 393000 in book income last year and he and his wife reported giving nearly 19000 to charity. Their federal taxes came to 145840 for an effective federal tax rate of 26. Senator Bernie Sanders I-Vermont accused Republicans of attempting to raise taxes on working families in a Saturday tweet.

Fortunately Bernie Sanders doesnt get to dictate what we do around here said Rep. Bernie Sanders I Vt proposed tax plan would raise taxes by 136 trillion over the next decade and reduce the economys size by 95 percent according to an. How Bernie Sanders Hopes To Reshape A Rigged Tax System Sanders will introduce legislation Thursday to restore the corporate tax rate to 35 and add a new progressive tax.

The Vermont senator said repealing the cap on the tax deduction would send a terrible message to voters. As you file your taxes today ponder how Bernie Sanders and his wife Jane want income taxes to go up on higher-income folks but managed to pay only a.

.png) How Danish Is Bernie Sanders S Tax Plan Tax Foundation

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_image/image/62973907/1126201872.jpg.0.jpg) Bernie Sanders Estate Tax Increase For The 99 8 Percent Act Explained Vox

Bernie Sanders Estate Tax Increase For The 99 8 Percent Act Explained Vox

Sanders Releases 10 Years Of Tax Returns Showing Income Bump From Campaign Book

Sanders Releases 10 Years Of Tax Returns Showing Income Bump From Campaign Book

Bernie Sanders Mega Tax Increases Largest In Peacetime History

Bernie Sanders Mega Tax Increases Largest In Peacetime History

Chart Visualizing Bernie Sanders Proposed Tax Reform Statista

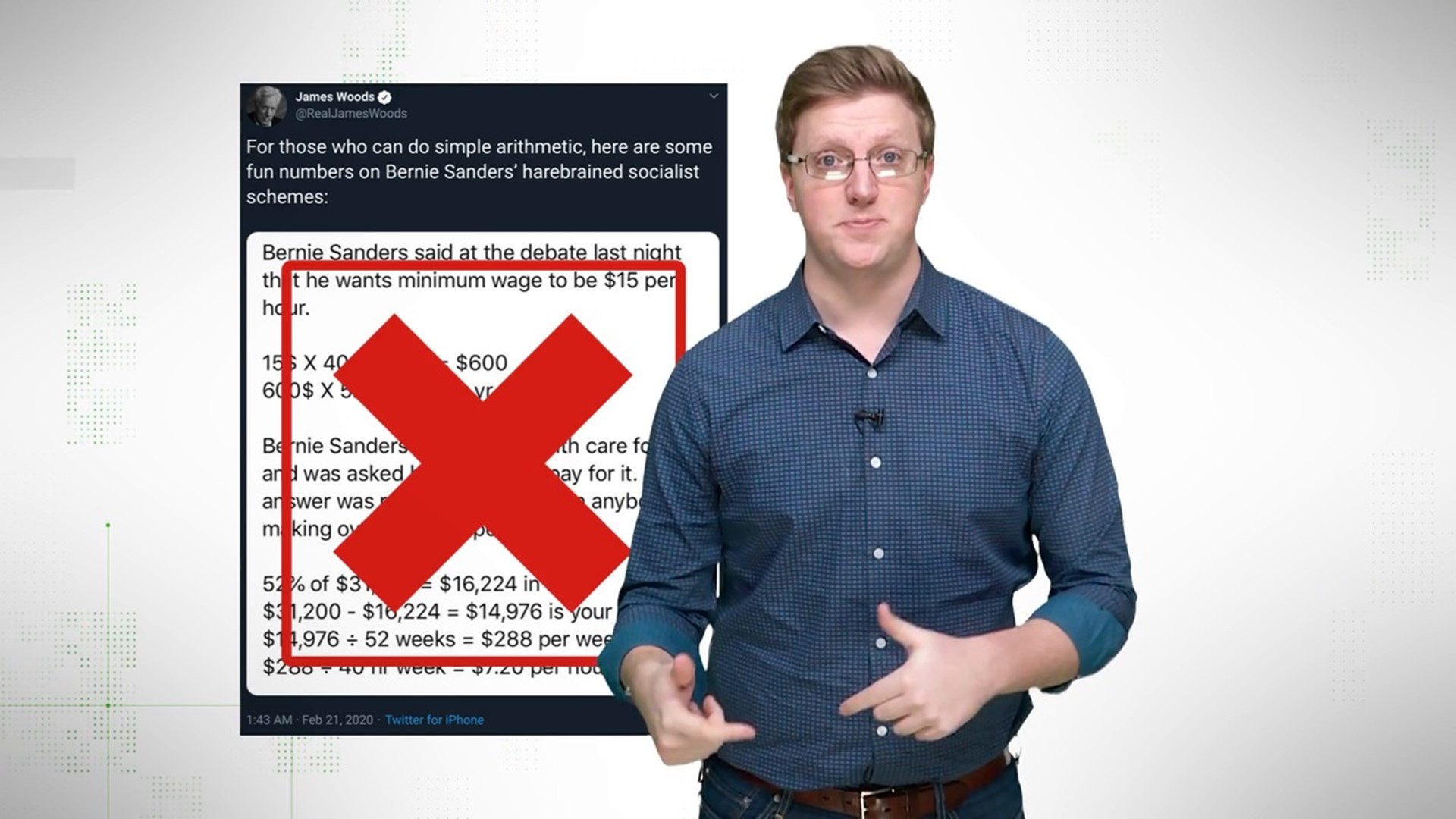

Verify Bernie Sanders Didn T Propose A 52 Tax Rate On Incomes Over 29 000 Wthr Com

Verify Bernie Sanders Didn T Propose A 52 Tax Rate On Incomes Over 29 000 Wthr Com

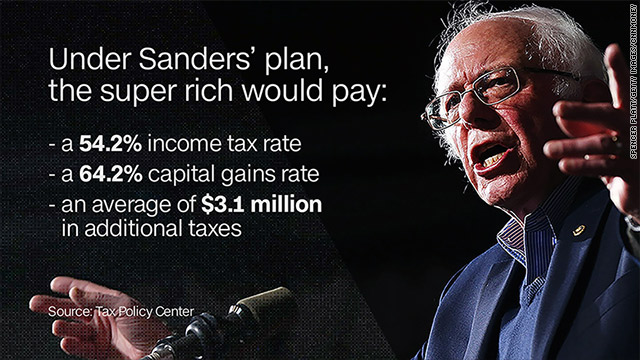

Bernie Sanders Rolls Out Wealth Tax Plan That Would Help Fund Medicare For All Cnn Politics

Bernie Sanders Rolls Out Wealth Tax Plan That Would Help Fund Medicare For All Cnn Politics

Sanders Takes Aim At Corporate America With New Tax Plan Thehill

Sanders Takes Aim At Corporate America With New Tax Plan Thehill

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

Politifact Viral Post Criticizes Bernie Sanders Math On Health Care Taxes It S Wrong

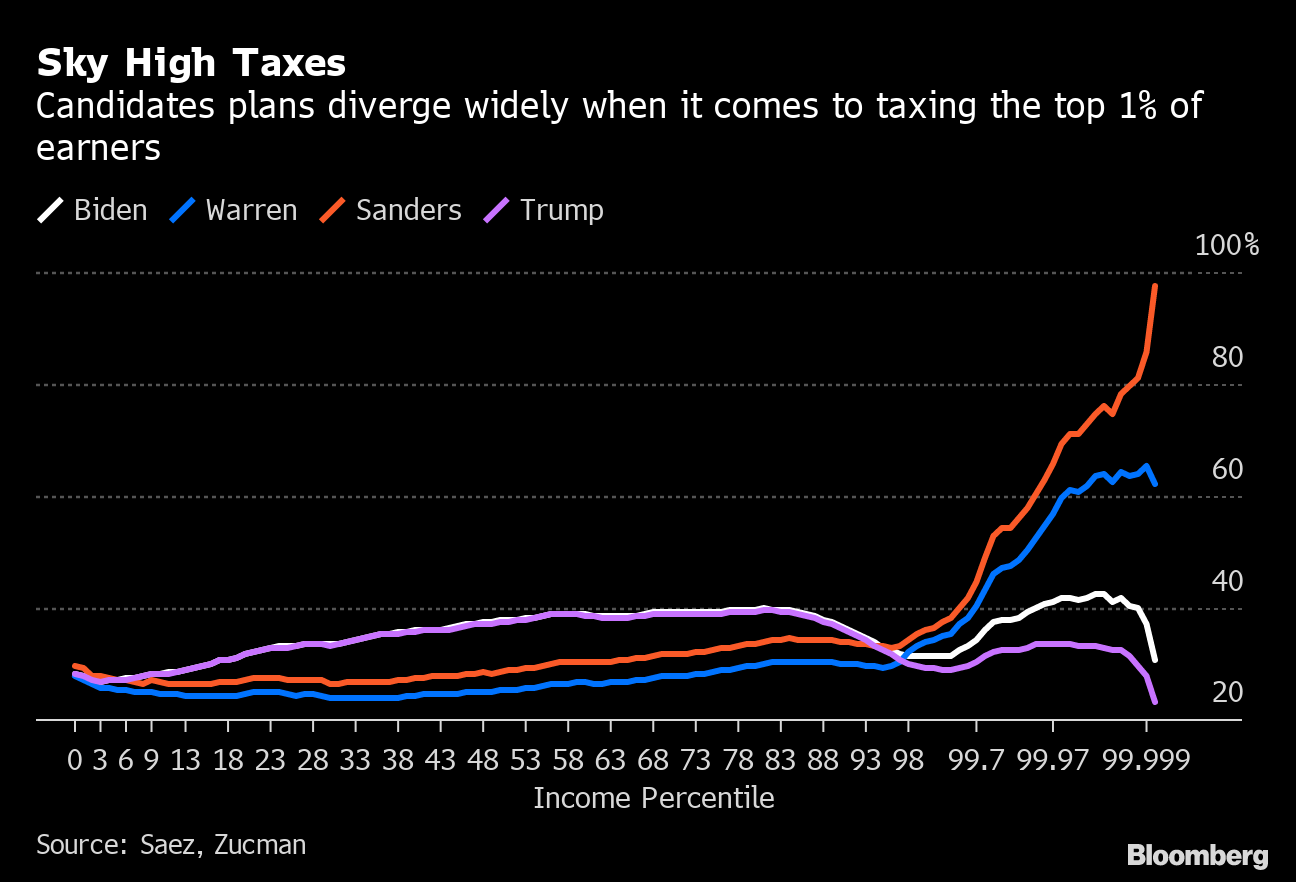

Billionaires Could Face Tax Rates Up To 97 5 Under Sanders Bloomberg

Billionaires Could Face Tax Rates Up To 97 5 Under Sanders Bloomberg

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.