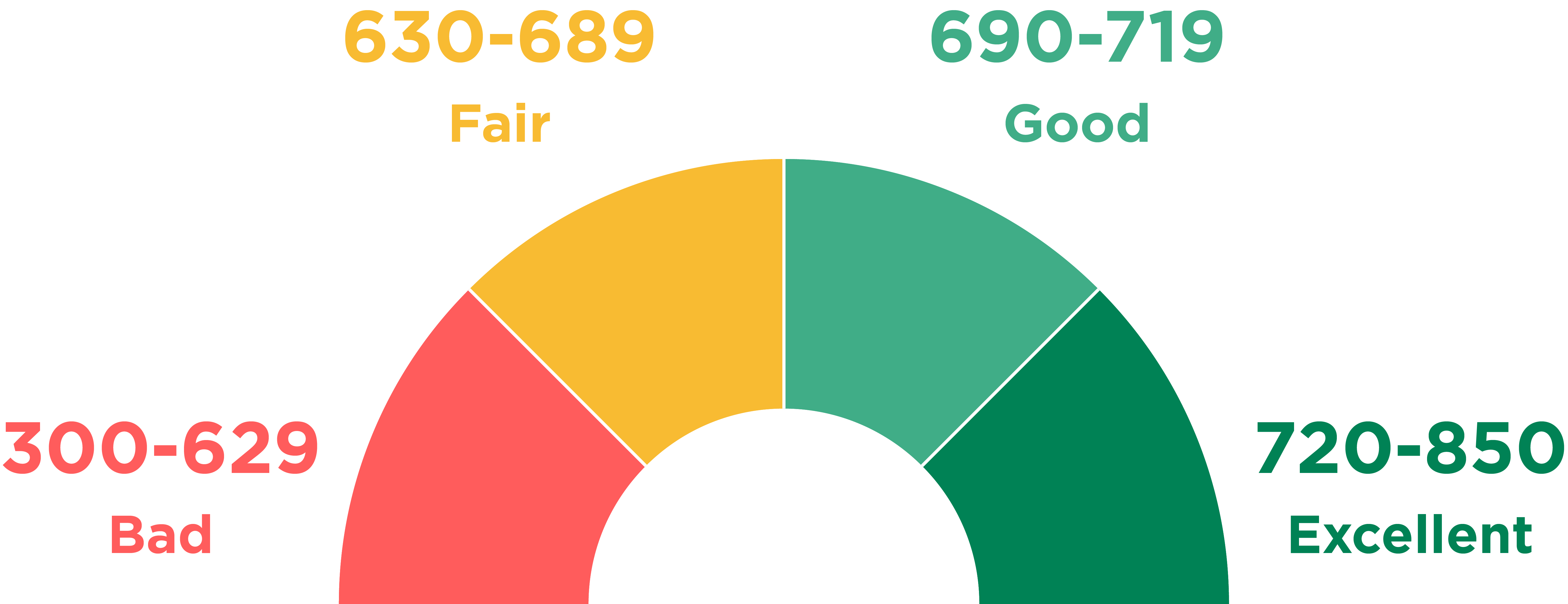

Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45 of your number. Since credit scores range from 300 850 300 could be considered the starting score.

How Much Does Your Credit Score Start At Credit Walls

How Much Does Your Credit Score Start At Credit Walls

A score of 800 or above on the same range is considered to be excellent.

Where does credit score start. Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six-month evaluation period. The credit score you start with will depend on how you deal with your first credit. Most consumers have credit scores that fall between 600 and 750.

The range for the credit score the lender is using. Credit scores are based on the information in our major credit reports and such reports arent even created until weve had credit eg a credit card or loan in our names for at least six months. So for many people the answer to the question when does your credit score start is at a young age upon obtaining a credit card or two.

Most peoples credit score doesnt start at the bottom of. The bar for excellence begins before 800 but the number to beat varies. Normally the higher the number the better the risk you are.

The first score you get wont be at the bottom of the scale but it wont be at the top either. A common misconception is that consumers start at the bottom of the credit ladder and move their way up. Your credit reports are maintained by three major credit bureaus Experian TransUnion and Equifax.

You can ask your lender which specific credit report it will pull and and which credit score it will use for your application. Still deciphering that information can be complicated. Usually you will get a credit score after your first 6 months of having credit.

The concept of credit scores started in 1989 and would evolve into todays most popular scoring model the FICO Score from Fair Isaac and Company. Dont worry if your score isnt more than 800 though. Lower scores indicate that someone is riskier to the lender in other words theyre less likely to repay debt.

Credit scores in the United States are numbers that represent the creditworthiness of a person the likelihood that person will pay their debts. Lenders such as banks and credit card companies use credit scores to evaluate the risk of lending money to consumers. It contains data on your current and past debts payment history residential history and other facts.

Which credit report from which credit bureau Equifax TransUnion or Experian your score is based on. There can be an element of truth to this but often its more nuanced than that. This data is supplied by lenders creditors and businesses where you have accounts.

A score of 800 or more is considered an exceptional FICO score. But this still doesnt answer what credit score do you start with. What credit score ranges mean for you.

Most credit scores range from 300 to 850 so theres no real zero. There will be 6 months worth of data to analyze and credit bureaus can assign you a score based on that data. Before the FICO Score credit was determined based on the character of the consumer.

More often than not starting credit scores fall within the fair range of 580 to 669. Provided you dont kick off your credit journey with lousy credit habits your. Your credit score can determine.

For a score with a range between 300 and 850 a credit score of 700 or above is generally considered good. Whether the lender is willing to lend you money. If a lender or issuer does.

Heres how your credit score range either FICO or VantageScore could affect your financial options. You might not be able to get approved for a loan or unsecured credit card at all. You can check if your credit score has started and what it is from any one of the three major credit reporting agencies Equifax Experian and TransUnion or sign up for an online service to check track and improve your credit score.

Lenders allege that widespread use of credit scores has made credit more widely available and less expensive for many consumers. A credit score is a number or category that reflects how good or bad a credit risk a particular lender thinks you are. Without any credit history reports and scores wont magically burst into existence when we turn 18 the age at which we first become eligible to apply for credit contrary to common myth.