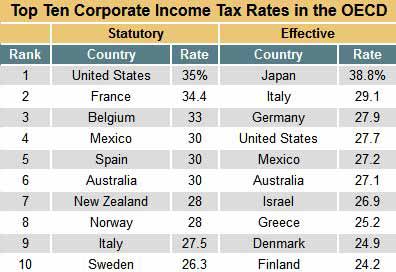

Above Average Compared to Peers US. This page provides - United States Corporate Tax Rate - actual values historical data forecast chart statistics economic calendar and.

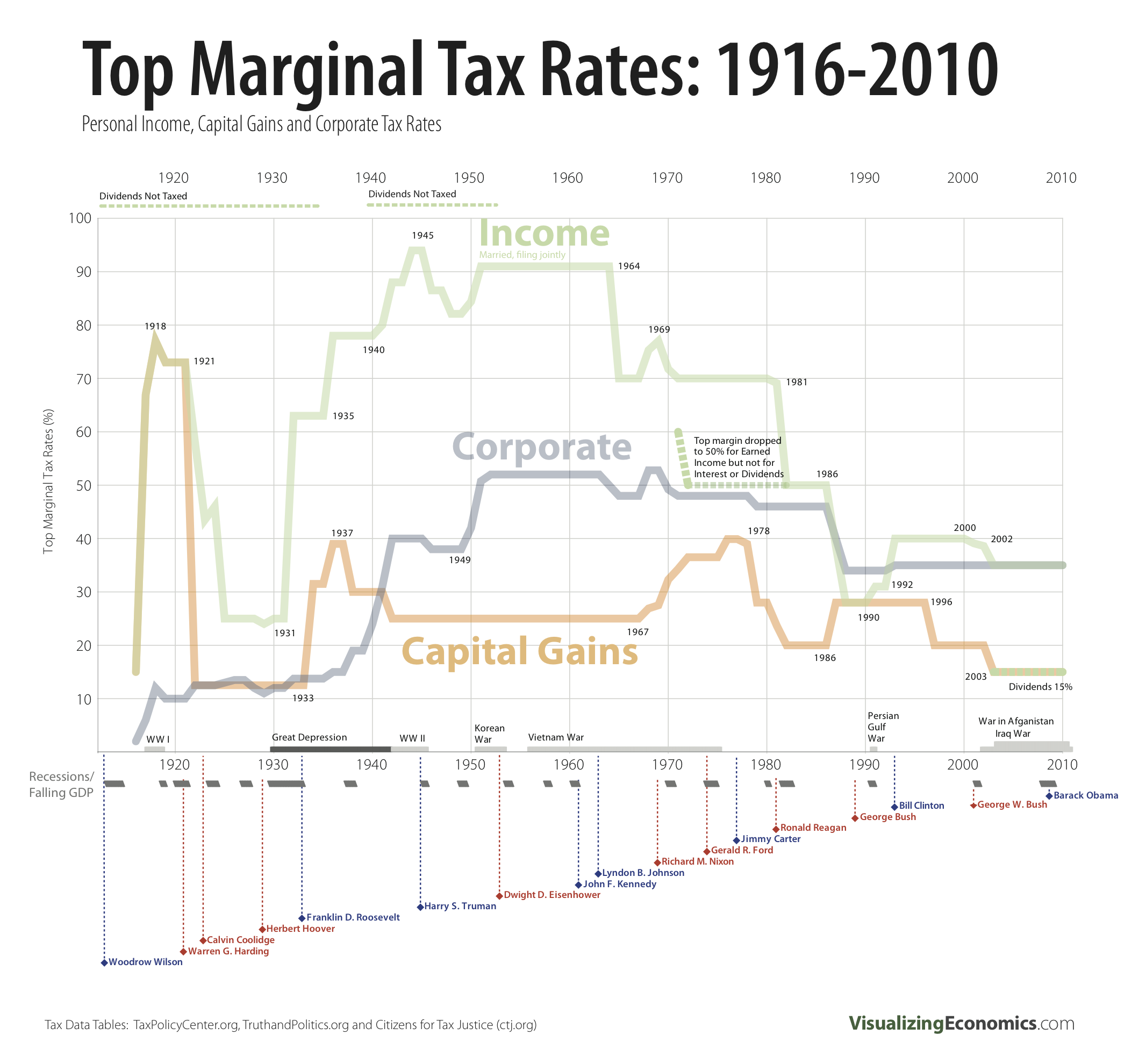

Historical U S Tax Rates Daily Dose Of Excel

3 Todays rate is set at 21 for all companies.

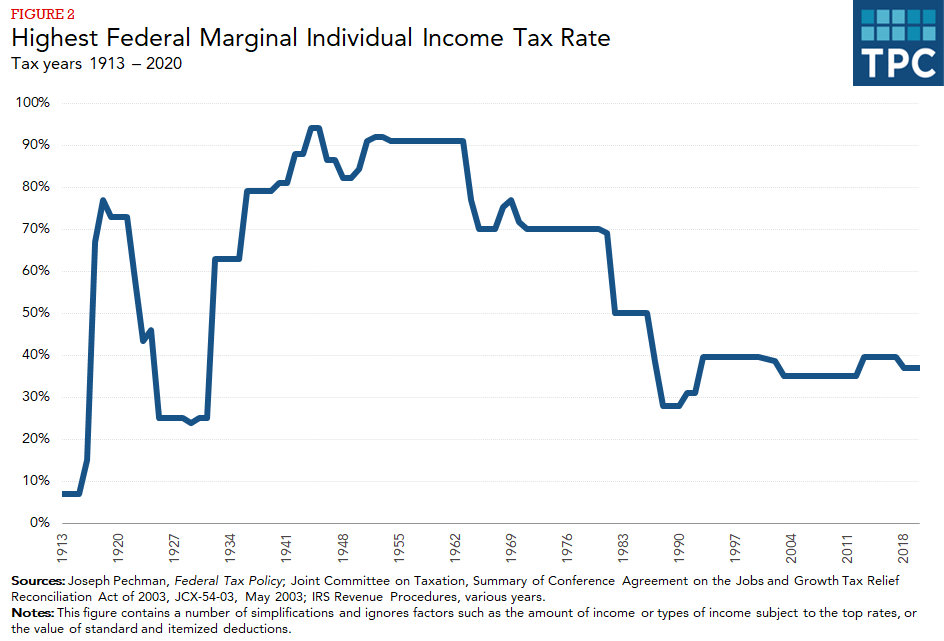

Us corporate tax rate history. The creation of the federal corporate income tax occurred in 1909 when the uniform rate was 1 for all business income above 5000. Since then the corporate income tax has ranged from 6 to 15 of. President Bidens proposal to raise the US.

The rate structure was designed so that a corporation with 335000 or more in taxable income faced an effective tax rate of 34 percent on the entire amount of its taxable income. Companies use everything in their disposal within the tax code to lower the cost of taxes paid by reducing their taxable incomes. The maximum capital gain rate was raised to 35 percent when the highest corporate rate bracket was increased in 1993.

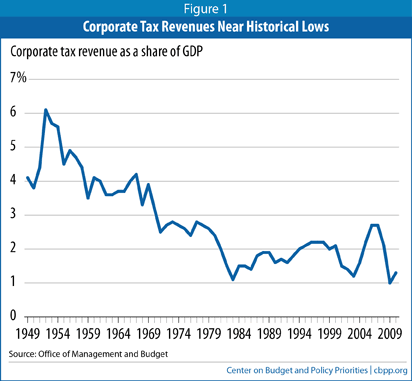

3 Since then the rate has increased to as high as 528 in 1969. Table 1 below gives a history of corporate tax rates from 1909 to 2002. According to an analysis from the Congressional Budget Office looking at corporate tax rates around the globe in 2012 this is essentially true.

25 Percent Corporate Income Tax Rate Would Make US. When President Trump signed the Tax Cuts and Jobs Act TCJA into law on Dec. These are the rates that applied to whatever the then-current definition of taxable income was.

34 100000 - 335000. 15 50000 - 75000. Average effective tax rates number of tax returns total adjusted gross income and total tax after credits for highest AGI groups 1935 to 2015.

37 rindas The creation of the federal corporate income tax occurred in 1909 when the. Required to pay at a higher tax rate 1932-1933 1942-1963 and allowed the option without penalty 1922-1931 1964 to the present. Most analyses suggest that in absolute terms this.

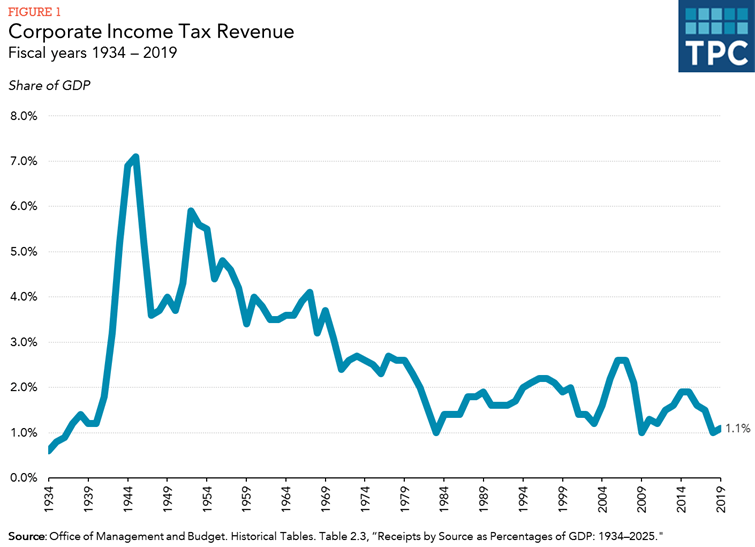

Corporate tax rate to 28 from 21 would mark the first increase since 1993 and sixth tax hike since 1945 he continued. 22 2017 it cut the corporate tax rate from 35 to 21 the lowest rate since. From 1952 to 1983 the corporate income tax began a long and steady decline.

Top Combined Integrated Tax Rate on Corporate Income Would Become Highest in the OECD Help us achieve our vision of a world where the tax code doesnt stand in the way of success. Itemized Charitable Contributions constant dollars 1917-2017. Effective tax rate by AGI 1935-2015.

25 75000 - 100000. Income and taxed at a maximum rate of 25 percent. 39 335000 - 10000000.

The top corporate tax rate has been on a downward trajectory ever since. Because of the complexity of. It was slashed during President Ronald Reagans administration from 46 down to.

Corporate Tax Rate in the United States averaged 3237 percent from 1909 until 2021 reaching an all time high of 5280 percent in 1968 and a record low of 1 percent in 1910. Since 1921 corporations earning most of their incomes in a US.

Corporate Tax In The United States Wikipedia

Corporate Tax In The United States Wikipedia

File Historical Marginal Tax Rate For Highest And Lowest Income Earners Jpg Wikimedia Commons

File Historical Marginal Tax Rate For Highest And Lowest Income Earners Jpg Wikimedia Commons

A Brief History Of The Individual And Corporate Income Tax Income Tax Income Financial Health

A Brief History Of The Individual And Corporate Income Tax Income Tax Income Financial Health

History Of Taxation In The United States Wikipedia

History Of Taxation In The United States Wikipedia

Corporate Tax In The United States Wikipedia

Corporate Tax In The United States Wikipedia

Fluctuations In Top Tax Rates 1910 To Today Sociological Images

Fluctuations In Top Tax Rates 1910 To Today Sociological Images

History Of Corporate Tax Rates Jobs Procon Org

History Of Corporate Tax Rates Jobs Procon Org

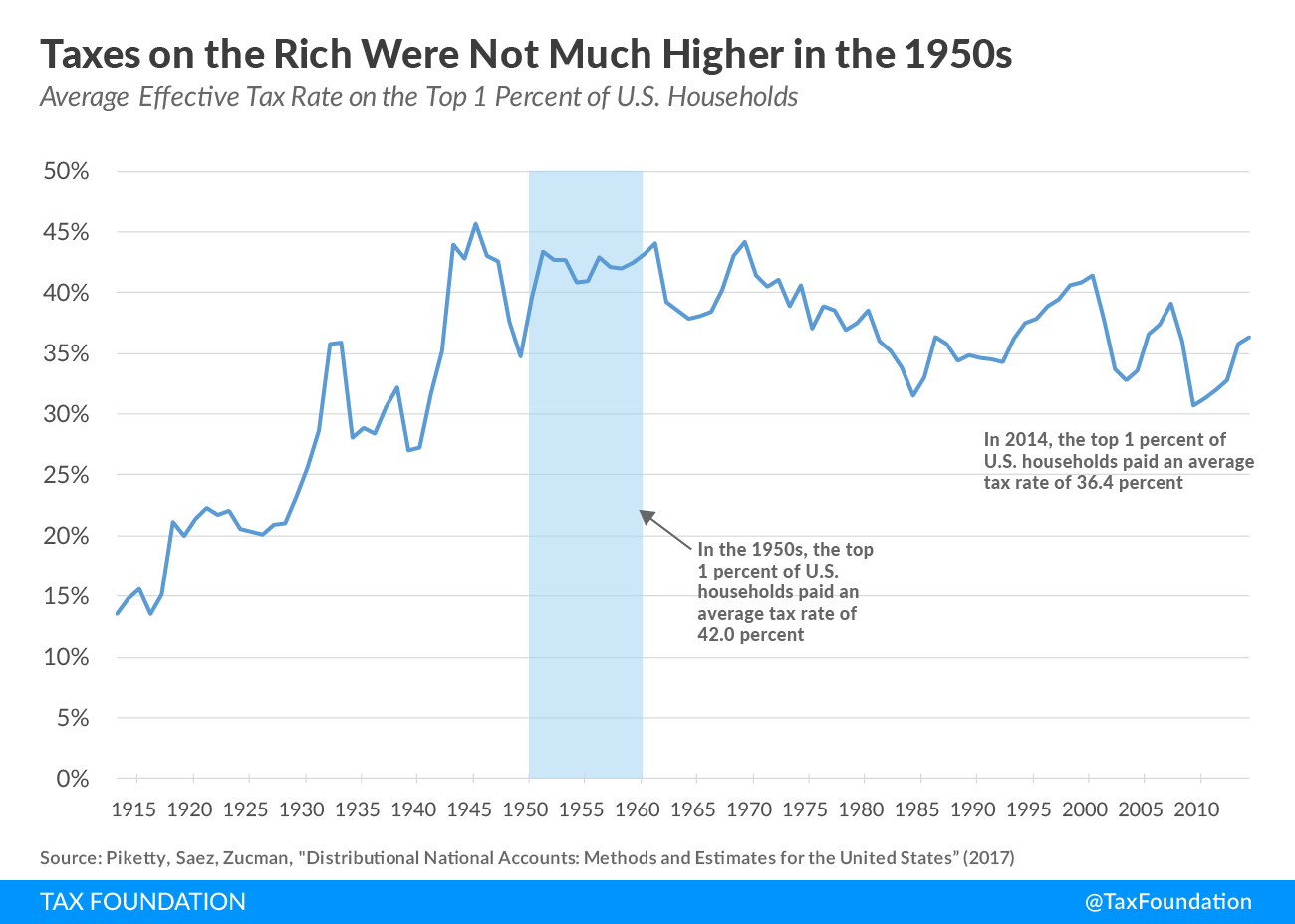

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

History Of Taxation In The United States Wikipedia

History Of Taxation In The United States Wikipedia

How Does The Corporate Income Tax Work Tax Policy Center

How Does The Corporate Income Tax Work Tax Policy Center

Six Tests For Corporate Tax Reform Center On Budget And Policy Priorities

Six Tests For Corporate Tax Reform Center On Budget And Policy Priorities

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Tax Reform The Key To A Growing Economy And Higher Living Standards For All Americans Testimony Before The U S House Of Representatives Committee On The Budget Tax Foundation

Tax Reform The Key To A Growing Economy And Higher Living Standards For All Americans Testimony Before The U S House Of Representatives Committee On The Budget Tax Foundation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.