Your net profit is equal to the gross receipts you earned minus your deductible business expenses. The simplest way to reduce taxable income is to maximize retirement savings.

18 Ways To Lower Your 2019 Tax Bill

18 Ways To Lower Your 2019 Tax Bill

Contribute to a Retirement Account.

How to lower the taxes i pay. Make sure to check for any local or state-wide tax credits you may be able to apply to further reduce the amount you pay in taxes. Among doctors these usually take the form of 457 b plans. How to Pay Less in Taxes Legally 1.

Next add in how much federal income tax has already been withheld year-to-date. Toys books clothes and other used household items may be donated to shelters or other charitable organizations that support the needy. Claim all the deductions you can.

Dont just deal with your taxes once a year in April. Giving money to non-profit organizations has long been a way for the wealthy to get a deduction on their taxes. And under the new tax.

Instead dedicate a folder or box to tax-related. Invested income than on. Look for local and state exemptions and if all else fails file a tax appeal to lower your property tax bill.

Both health spending accounts and flexible spending accounts help reduce tax bills during the years in which. This credit will reduce his tax bill to zero. Deferring income from the current year into the next is one way to delay paying taxes and reduce the current years taxable income.

Make sure you have a recent pay stub handy so that you can use your actual income amounts. This is paid to you in interest dividends and appreciation of your assets. The state of Florida for example has the Homestead Act which gives a tax credit to homeowners who live in the state year-round.

Calculating Your Total Withholding for the Year Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year. Adjusted gross income AGI is the baseline for calculating your taxable income. If your earnings total 75000 and you can take a 5000 deduction your taxable income will fall by 5000 and youll be.

Use Your Side Hustle to. Traditional IRA contributions can save you a decent amount of money on your taxes. Heres how a deduction works.

Open a Health Savings Account. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax. People in business can deduct all their business expenses such as inventory office or home office travel operating costs and so on.

Retirement account contributions are a top tax-reduction tool as they serve two purposes. Contribute to a 401k 403b 457 Plan or IRA. Our society through its elected representatives has decided to encourage the long-term investment of capital offering lower tax rates on qualified dividends and long-term capital gains ie.

If youre in the 32 income tax bracket for instance a 6000 contribution to. Claim all the tax credits you can. You must include this as income on your 1040 and use it on Schedule SE to calculate your self-employment tax.

Dont miss these tax deductions and credits which can add up to significant savings. The lower your net profit number is the lower your self-employment tax bill will be. But you dont necessarily have to make less money to lower your tax bill.

Perhaps the most well-known way to reduce taxable income is to take tax deductions. 18 Ways to Reduce Your Taxes. The Retirement Savings Contributions Credit or Savers Credit offers taxpayers a credit of 10 20 or 50 of contributions to retirement savings accounts such as a 401k or an IRA.

First up be organized. Although this strategy can save taxes in the current year. Charitable contributions offer a tried-and-tested way to reduce the tax billand there are a number of ways to give back beyond writing a check.

Some employers offer plans that allow you to defer your compensations for years or even decades. Donate money goods or stock to charity. For example if youre an employee and youre due a year-end bonus you can ask your employer if theyre willing to push that payment into next year.

The more deductions you have the less tax youll pay. Like a 401 k you get to choose and control the investments. The higher your AGI the more you can expect to owe.

Johns Retirement Savings Contributions Credit will be 545. The less income you have the lower your taxes will be. Unlike the 401 k it is still your employers money and subject to your employers creditors.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png) Tax Avoidance And Tax Evasion What Is The Difference

Tax Avoidance And Tax Evasion What Is The Difference

Face It You Probably Got A Tax Cut The New York Times

Face It You Probably Got A Tax Cut The New York Times

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Less Taxes On A Six Figure Income Real Life Example

How To Pay Less Taxes On A Six Figure Income Real Life Example

8 Ways To Pay Less In Taxes And Save Money

8 Ways To Pay Less In Taxes And Save Money

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How Fortune 500 Companies Avoid Paying Income Tax

4 Ways To Pay Less Tax And Cut Your Income Tax Taxact Blog

4 Ways To Pay Less Tax And Cut Your Income Tax Taxact Blog

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

The 7 Ways The Rich Pay Less In Taxes And You Can Too

The 7 Ways The Rich Pay Less In Taxes And You Can Too

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png) Estimating Taxes In Retirement

Estimating Taxes In Retirement

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Less Or No Taxes Guide To Reduce Your Taxable Income

How To Pay Less Or No Taxes Guide To Reduce Your Taxable Income

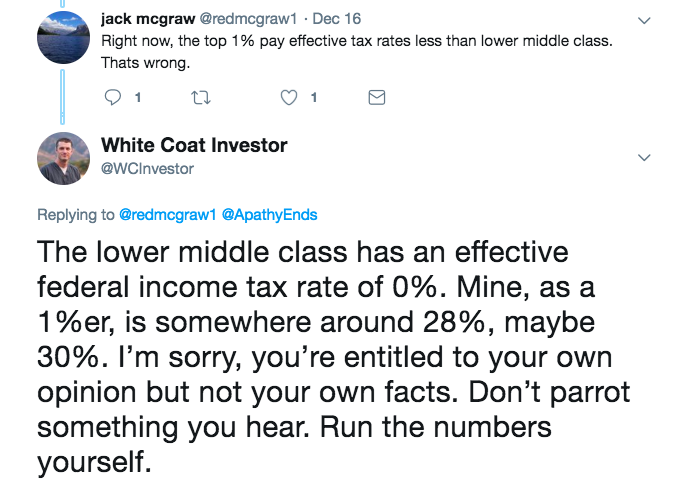

Many Lower And Middle Income Households Could Pay Zero In Taxes

Many Lower And Middle Income Households Could Pay Zero In Taxes

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.