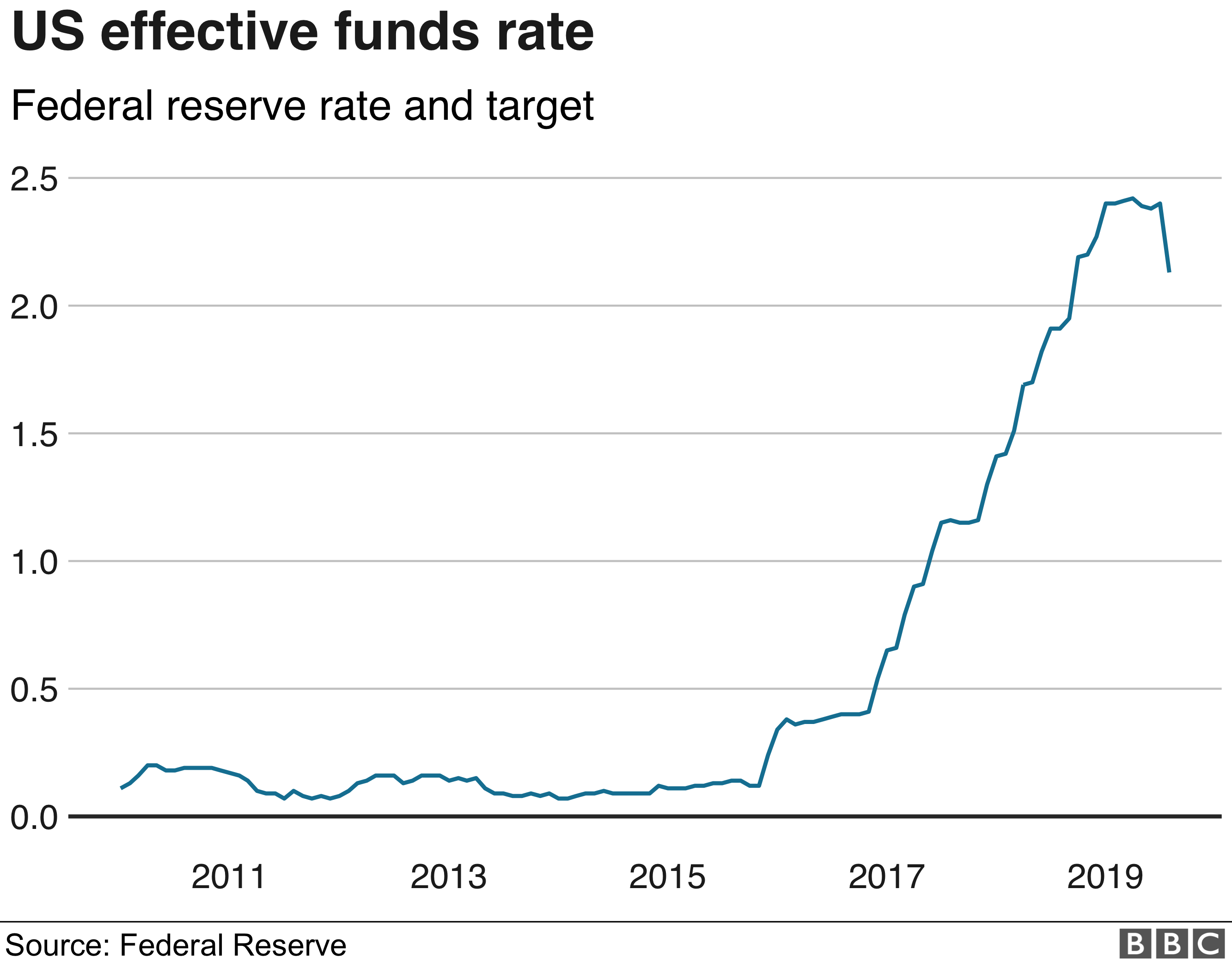

The Current US. Prior to March 1 2016 the EFFR was a volume-weighted mean of rates on brokered trades.

Why The Fed S Interest Rate Move Matters Bbc News

Why The Fed S Interest Rate Move Matters Bbc News

It stayed there until December 2015.

What is the fed interest rate today. The FOMC has voted to leave the. Fed Prime Rate is. Interest rates will be on April 28 2021.

As of right now our odds are at 100 certain the Federal Open Market Committee will vote to leave the target range for the benchmark fed funds rate at the current 000 - 025 at the December 16 TH 2020 monetary policy meeting and keep the United States Prime Rate aka Fed Prime Rate at 325. Fed Funds Rate Current target rate 000-025 025 What it means. Federal Reserve System FED.

110 down from 111 last week. 4 The last time it lowered the rate to this level was in December 2008. The prime rate today is 325 according to the Federal Reserve and other sources.

Prime rate federal funds rate COFI Updated. Sep 2021 - up by at least 25 bps. Jun 2021 - up by at least 25 bps.

From February 18 2002 to. With regard to interest rates we continue to expect it will be appropriate to maintain the current zero to 025 percent target range for the federal funds rate until labor market conditions have. Target range for the fed funds rate at 0 - 025.

5 On March 9 2020 the 10-year Treasury yield fell to a record low of 054. 30-year Treasury constant maturity series was discontinued on February 18 2002 and reintroduced on February 9 2006. The current federal reserve interest rate or federal funds rate is 0 to 025 as of March 16 2020.

The interest rate at which banks and other depository institutions lend money to each other usually on an overnight basis. Fed funds futures probabilities of future rate changes by. On September 18 2019 the Federal Reserve also called the Fedcut the target range for its benchmark interest rate by 025.

At this time the FED has adopted an interest rate range of 000 to 025. In the long-term the United States Fed Funds Rate is projected to trend around 025 percent in 2022 according to our econometric models. 140 up from 105 last week.

The next FOMC meeting and decision on short-term. Therefore the United States Prime Rate remains at 325. The FOMC lowered it to that level on March 15 2020 to support the economy during the COVID-19 pandemic.

137 down from 145 last week. Looking forward we estimate Interest Rate in the United States to stand at 025 in 12 months time. The current American interest rate FED base rate is 0250 Note.

The current fed funds rate target range is 0 to 025. As of March 1 2016 the daily effective federal funds rate EFFR is a volume-weighted median of transaction-level data collected from depository institutions in the Report of Selected Money Market Rates FR 2420. The federal reserve ordered two emergency decreases to.

In the United States the authority to set interest rates is divided between the Board of Governors of the Federal. The current prime rate is 3 percentage points above 025 which is the top of the range for the current federal funds rate the benchmark interest rate the Fed controls. The 2-month constant maturity series begins on October 16 2018 with the first auction of the 8-week Treasury bill.

FRB Rates - discount fed funds primary credit Interest Rates Money Banking Finance Sources More Releases from Board of Governors of the Federal Reserve System US. The Fed said Sunday that it was cutting its benchmark federal funds rate by 1 to a range of 0 to 025 alongside other measures meant to stimulate the nations economy as it takes a. This week Month ago Year ago.

Dec 2021 - up by at least 25 bps.