Two of BlackRocks British pension fund clients have urged the asset manager to support a climate resolution filed by a group of shareholders at HSBCs annual meeting in April. Some may question the science but all are faced with a swelling tide of climate-related regulations and technological disruption.

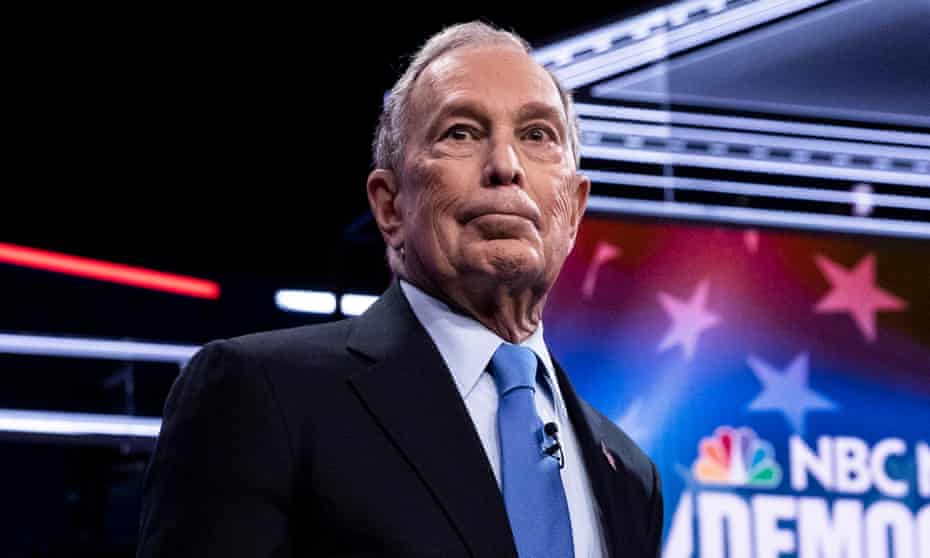

Asset Manager Blackrock Threatens To Sell Shares In Worst Climate Polluters Financial Sector The Guardian

Asset Manager Blackrock Threatens To Sell Shares In Worst Climate Polluters Financial Sector The Guardian

They are seeking to understand both the physical risks associated with climate change as well as the ways that climate policy will impact prices costs and demand.

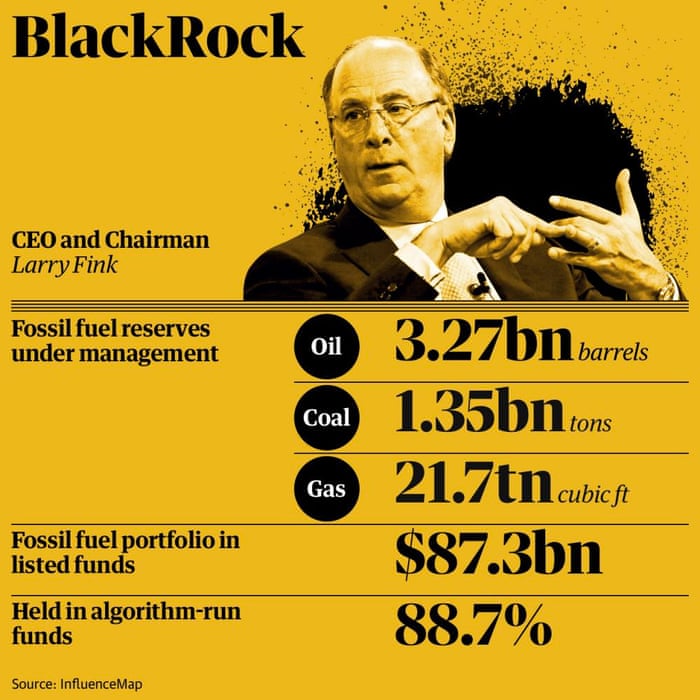

Blackrock climate change. BlackRock has been in the crosshairs of climate change activists in the past. BlackRock which holds 7tn in assets has come under intense pressure to reform the funds it offers investors. Climate change changes investing On this episode of the BlackRock Bottom Line Jean Boivin Head of the BlackRock Investment Institute explores why we believe the climate transition will boost portfolios.

Last year as raging wildfires charred vast swaths of the Amazon protestors blocked the entrance to. From Europe to Australia South America to China Florida to Oregon investors are asking how they should modify their portfolios. The relative importance of these factors depends on the trajectory of the pathway toward a low-carbon world and the asset owners time horizon.

Climate change has become a defining factor in companies long-term prospects But awareness is. BLACKROCK INVESTMENT INSTITUTE5 Climate risks We see climate change creating risks and opportunities to investment portfolios in four areas. BlackRock said 78 per cent of global.

Indeed climate change is almost invariably the top issue that clients around the world raise with BlackRock. Investing in climate change and resource scarcity with BlackRock iShares. Overview The green transition Affecting all assets Portfolio impact.

BlackRock Investment Institute Sep 6 2016. It is also well documented for. BlackRock Singapores Temasek in mammoth climate investing push New joint venture aims to raise billions of dollars for firms that help reduce dependence on fossil fuels.

Das bedeutet dass das Portfolio von BlackRock eine enorme Gefahr darstellt den Planeten auf einen Weg zum außer Kontrolle geratenen Klimawandel zu bringen tatsächlich trägt BlackRock mehr zum Klimawandel bei als fast jedes andere Unternehmen auf der Erde. BlackRock has punished more than 50 companies from US oil major ExxonMobil to Swedish carmaker Volvo over their lack of progress on tackling global warming six months after it warned of huge. Climate change and resource scarcity is one of BlackRocks five megatrends - powerful transformative forces that could change the global economy business and society have been changing the way we live for centuries.

Awareness is rapidly changing and I. In an annual letter to CEOs published Tuesday BlackRock chief executive Larry Fink said. We show how to mitigate climate risks exploit opportunities or have a positive impact.

It found that they are already appearing in a meaningful way in the form of higher insurance premiums for fires and. Fink asked BlackRock to research the economic impacts of climate change. BlackRock must commit to Indigenous rights not just climate change commentary BlackRock is an investment management firm reportedly with 8 trillion in assets.

The environmental group is one of the partners in BlackRocks Big Problem a global network of NGOs and financial advocates pressuring asset managers for change. BlackRock has been accused of double standards after it refused to back landmark environmental resolutions at two big Australian oil companies just months after the worlds largest asset manager. Physical technological regulatory and social.

Mr Harman said there was a chronic lack of climate change and ESG solutions in the sovereign space which is a big paradox because its such a big market. In an annual letter to CEOs earlier this year BlackRock Chairman and CEO Larry Fink said climate change has become a defining factor in companies long-term prospects. This is a welcome shift in.

Over the past three years BlackRock has increased pressure on companies to take more aggressive steps to lower their environmental impact. But awareness is rapidly. Investors can no longer ignore climate change.