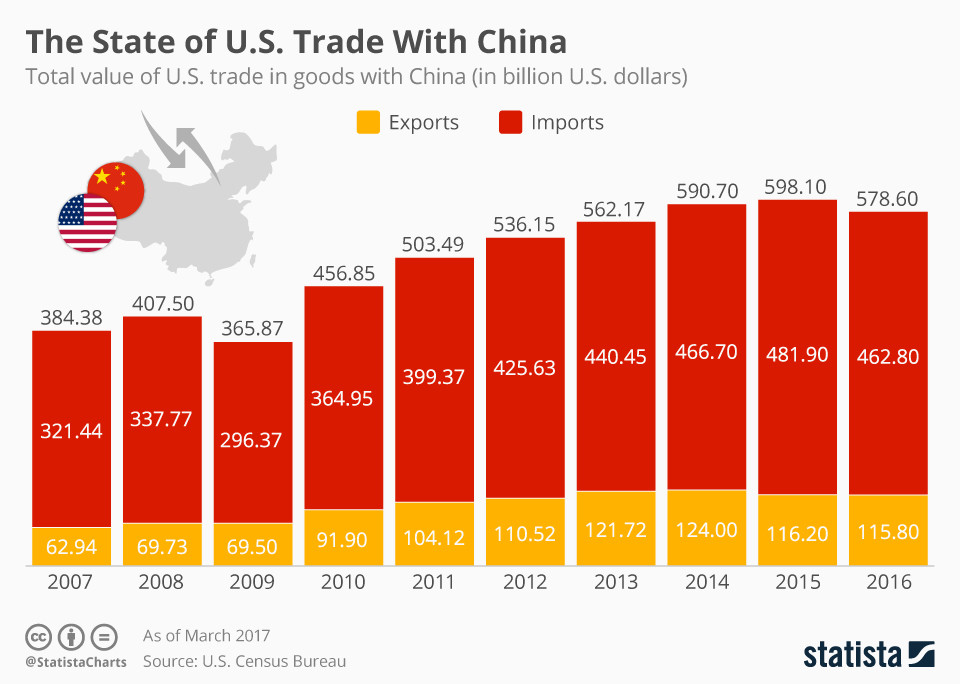

After Beijing retaliated in response to those duties it started a. The trade deficit in goods hit.

Here S What You Need To Know About The Us China Trade Dispute World Economic Forum

Here S What You Need To Know About The Us China Trade Dispute World Economic Forum

The Canada Border Services Agency CBSA has placed temporary tariffs on sofas and chairs coming in from China and Vietnam and are flooding the market.

What are the tariffs on china. These tariffs cover 664 percent of Chinese. In an email to Global News the agency said. China has put tariffs on American-made goods too.

That means Chinese buyers have an incentive to buy certain items from. Tariffs have already started to reduce that trade which in turn reduces Chinas ability to harm US. Products are to be exempt from additional tariffs.

Australian winemakers and exporters should actively consider other Asian countries with less mature wine markets and expanding middle classes who present attractive growth opportunities such as India Thailand and Vietnam. This tax law includes two exceptions to the 25 flat rate. Consumers have looked elsewhere for tariffed goods.

If the goal was to reduce imports from China then it succeeded Craig Allen president of the US-China Business Council told the WSJ. Most of the elevated tariffs imposed at the height of the US-China trade war have remained in place and affect over half of all trade flows. The tariffs would be the second round of taxes China would have applied to U.

Tariffs currently affect 250 billion worth of Chinese imports while they affected about 370 billion in goods in 2018 and 2019 showing that US. China will extend a tariff exemption for 79 products imported from the United States that is due to expire on May 18 the finance ministry said in. Average US tariffs on imports from China remain elevated at 193 percent.

Trump initially imposed tariffs on 50 billion worth of Chinese goods in 2018 in separate batches of 34 billion and 16 billion. The US will maintain its tariffs of 25 per cent on steel and 10 per cent on aluminium which also apply to imports from China India Russia Turkey Norway and Switzerland. Tariffs have led to a sharp decline in Chinese imports and significant changes in the types of goods Americans buy from China new data show with purchases of telecommunications.

About 58 of US exports to China are affected with an average rate of 21. The corporate income tax rate in China is 25. Even if the US adjusts its tariff policy in general lowering or rolling back tariffs on China wont come easily and the general trend of the US stepping up competition with China.

One for qualified small-scale and thin profit companies which will pay 20 and another to encourage investment by high tech companies which will pay 15. Chinese tariffs likely to impact Australias wine market share in China in the near- to medium-term unless a quick resolution is reached. President Donald Trump has heightened tensions with China by escalating his tariffs on 200 billion in Chinese goods from 10 to 25.

As a tool of national policy tariffs had long been fading into. The February 14 2020 implementation of the phase one deal between the United States and China established new US tariffs on imports from China for the foreseeable future. The Trump administration says its tariffs imposed two years ago on more than 200 billion in Chinese goods were justified because China was stealing intellectual property and forcing US.

These tariffs are more than six times higher than before the trade war began in 2018. The Customs Tariff Commission of Chinas State Council said 79 US.