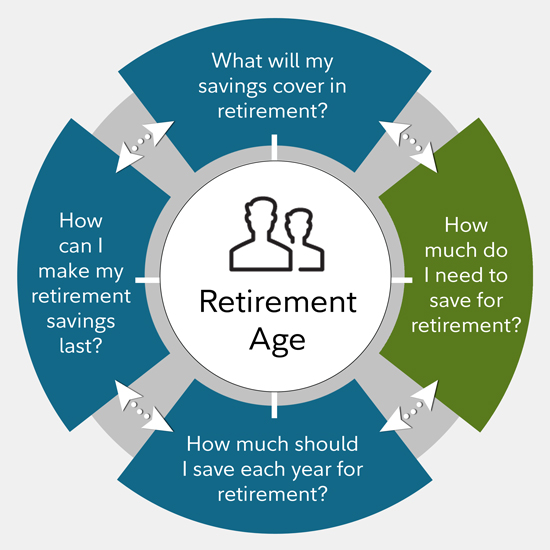

Other horses can be ridden late into their life without issues. 66-67 Depending on your year of birth your Full Retirement Age FRA will be between 66 and 67.

How Much Do I Need To Retire Fidelity

How Much Do I Need To Retire Fidelity

The expected age of retirement was 65 and the stories that got peoples attention were those who were able to.

What age should i retire. The normal retirement age for these is typically 65 but you might be able to take your retirement income earlier or defer it until later. For those born after 1960 the full retirement age is 67. What do I need to retire early.

Boost your retirement income The cash doesnt have to stop just because youve finished working. Any horse no matter their age still requires a decent amount of exercise. For those born before 1937 the full retirement age is 65.

You can consider early retirement to be any retirement before the age of 65 but well focus mainly on a retirement that happens at some point in your 50s. As a general rule most horses should stop being ridden between 20 to 25 years old. If you were born before 1937 your full retirement age is 65.

If youre in this age group you have the best chance of reaching your financial goal in the shortest amount. The average age people 45 said they intend to retire also increased to 65 up from 63 a decade earlier. The lowest minimum retirement age is 55 for workers born before 1948 and 56 for workers born in 1963 or 1964.

For those born after 1960 the full retirement age is 67. Some horses have physical conditions or diseases that require an early retirement. Planning to get rid of debt is an important part of pre-retirement planning.

Common triggers include attaining a milestone age such as eligibility for Social Security at age 62 becoming eligible for Medicare at age 65 attaining your Social Security full retirement age. The goal was to amass as much money as possible to live well during retirement. Although your horse may begin to show signs of age that indicate a need to slowly introduce retirement.

Preparing emotionally to retire 70-year-old Jay Cassie talks about how she prepared and the 3-point plan which helped her. The average age of retirement in the US. If you retire before full retirement age your monthly benefits will be permanently less than your full retirement benefitsince you will be receiving them for a longer period.

Heres a guide to help you determine your full retirement age and how it affects you. If youre 45 and have no. For those born after 1960 youre eligible for full retirement at 67.

For those born in 1960 or later full retirement age is 67. If you take your retirement income early youre likely to get a significantly reduced amount. How to Retire at 62.

66-67 -- Full retirement age for Social Security is 66 to 67 years old depending on when you were born. For example if you were born in 1955 your FRA is 66 years and 2 months while if your birth year was 1959 your FRA is 66 years and 10 months. There is no set age for retiring your horse.

If you were born somewhere between 1937 and 1960 your full retirement age is somewhere in between you can check yours with the Social Security Benefits Planner. This is consistent with the findings of the governments Retirement Income Review released in November 2020 which found the average retirement age is currently 62 to 65 years with women tending to retire 1 to 3 years before men. What is the best age to retire from nursing How long do you have to work as a nurse before you can retire Is there an age limit for nursing.

10 Zeilen If you were born on January 1 st you should refer to the previous year. Well traditionally retirement has been from the age of 60 to 65 as reflected by the state pension age though this is now rising. How you could make your money go further.

If youre 35 and started investing 625 a month at age 25 you should have around 135000 in your. Ages 2535. This makes sense as 62 is the earliest age you can start collecting your.

Since the SECURE Act pushed out the age from which you have to take distributions it still makes sense to fund a retirement account says Sarah Heegaard Rush a Certified Financial Planner with. Minimum Retirement Age The minimum retirement age MRA for eligible employees is 57 for anyone born in 1970 or later. At age 50 and above you should be more careful with the investment risk you are taking.

If you decide to take CPP early at age 60 your benefits are reduced by 72 per year until you turn 65 standard retirement age.